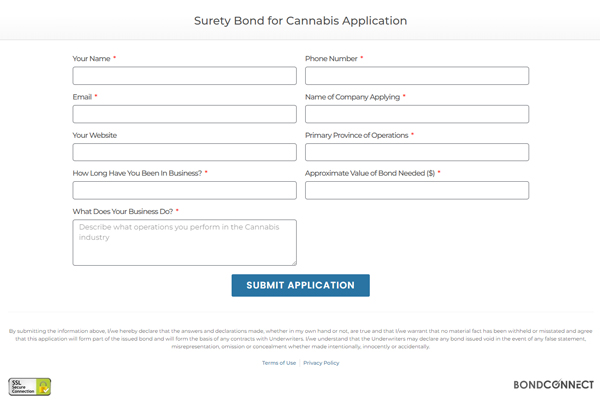

Surety Bond for Cannabis

Cannabis Tax & Excise Bond L302

A Surety Bond for Cannabis L302, also known as a Cannabis Tax Bond is a type of Customs Bond required by the Government of Canada for excise duty requirements for licensed cannabis producers.

A Cannabis Surety Bond is a financial guarantee for CRA and ensures you don’t need to tie up capital as a taxation deposit in the marijuana industry. Learn more below and apply for yours online today!

What is the L302 Surety Bond for Cannabis?

The L302 Surety Bond for Cannabis is a three party security agreement that is required by the Government of Canada. It guarantees your compliance with excise duty requirements to the Canadian Obligee: Her Majesty the Queen in Right of Canada. The bond typically has a value between $5,000 – $5,000,000 + when needed. The value required will depend on the specifics of your business and production volumes. Credit and financial standing are important aspects of being approved for this cannabis security bond.

If you’d like to review a sample wording of the bond you can do so on the Government of Canada website by clicking here.

Why do I need a Cannabis Tax Bond in place?

Beginning in May of 2018, the Government of Canada has implemented a requirement for excise duty for licensed cannabis producers in the country. Utilizing this bond enables you to maintain compliance with Canadian standards while not tying up the capital you need to run your business in forms of instruments like Letters of Credit.

In 2017, the Canadian Government stated its commitment to implementing a new taxation regime on marijuana to ensure they are taking steps to have taxation levels remain effective in the future. The proposed Excise Duty Framework is designed to support the Government’s goals for the legalization and regulation of cannabis – this includes restricting youth access, and preventing illegal activities.

How much does a Cannabis Surety Bond cost?

The cost of a Surety Bond for Cannabis may vary depending on the bond amount needed, effective duration, financial position of the business requesting the bond, and more. At this time, the Government of Canada is determining the amount of duty owed and value of your bond based on either of the following:

- A Flat Rate to be applied to the quantity in grams of cannabis contained in a final product sale.

- A Percentage of the licensee's sale price of the product to be packaged and distributed.

Please get in touch with a Government of Canada representative to confirm the value of the bond you will require prior to completing an application. Writing cannabis surety bonds will involve an underwriting process that ensures regulations governing the marijuana industry and can be quite extensive.

Not to worry, we work with you to ensure you’re getting the best rates available in the market today.

The History & Future of Cannabis Regulations in Canada

Canada’s journey with cannabis regulations has been a dynamic one, marked by significant shifts in policies and public perception.

Historical Perspective

Before the introduction of the L302 Surety Bond for Cannabis, Canada’s stance on cannabis underwent numerous changes. From the days of strict prohibition to the more recent times of decriminalization and eventual legalization, the nation’s approach to cannabis has evolved in response to societal, economic, and global influences.

Introduction of L302 Cannabis Surety Bonds

In May 2018, a landmark decision saw the introduction of the L302 Surety Bonds for Cannabis. This bond became a mandatory requirement for licensed cannabis producers in Canada, ensuring compliance with excise duty requirements and reflecting the government’s commitment to a regulated cannabis market.

Looking Ahead for Cannabis Regulations

The future of the cannabis industry in Canada promises further evolution. As the market matures, there could be potential changes in regulations, driven by emerging market trends, research findings, and global shifts in cannabis policies. Businesses must stay informed and agile, adapting to regulatory changes while capitalizing on new opportunities.

Bond Connect remains committed to supporting businesses in this dynamic landscape, offering guidance and surety bond services tailored to the ever-changing needs of the cannabis industry in Canada.

FAQ for Cannabis Surety Bonds L302

Q: What happens if I don’t obtain a Surety Bond for Cannabis L302?

A: Failing to obtain a Surety Bond for Cannabis L302 can result in legal consequences and potential business disruptions. Without this bond, businesses could face fines, license suspension, or even license revocation by the Government of Canada. Additionally, they might be deemed non-compliant with excise duty requirements, jeopardizing their reputation and operations.

Q: Can I renew my bond through Bond Connect?

A: Yes, you can renew your bond through Bond Connect. As the bond’s expiration date approaches, businesses can seamlessly renew it using online or via e-mail, ensuring continuous compliance without any interruptions.

Q: Are there any penalties associated with the bond?

A: Yes, there can be penalties if the terms of the bond are breached. If a business fails to meet the excise duty requirements stipulated in the bond agreement, they might be required to pay a penalty. This could range from a percentage of the bond value to the full bond amount, depending on the severity of the breach and the terms set by the Government of Canada.

Q: Is my personal or corporate credit and financial standing important?

A: Absolutely. Both personal and corporate credit scores, as well as overall financial health, play a crucial role in the bond application process. A strong credit score and solid financial standing can lead to more favorable bond terms and potentially lower premium rates. Conversely, a poor credit history might result in higher premiums or even challenges in obtaining the bond. It’s essential to maintain good financial practices to ensure smooth bond procurement and renewal processes.

Reliable Canadian Underwriters

Online Bond Application

Best Price Nation Wide

E-Bonds When Possible

Automated Renewal Reminders

How It Works

What is the Meaning of Bondable in Canada? The “3 C’s” of Surety

Surety bonds play a crucial role in various industries and sectors across Canada. They provide a level of financial security and guarantee that a business

What Does Artificial Intelligence Mean for the Surety Industry?

An Introduction to OpenAI and ChatGPT OpenAI is a leading artificial intelligence research laboratory that is widely known for its innovative approach to machine learning