Basics of Surety Bonds in Canada

Surety bonds play a crucial role in the Canadian economy by providing a guarantee for the performance of specific actions agreed upon in a contract. Bonds are not insurance and have some fundamental differences. While insurance policies provide protection against unforeseen events, surety bonds are designed to protect against the failure of a specific action. in other words, a surety bond is a guarantee that a certain action will be performed, whereas an insurance policy is a way of mitigating the financial impact of unpredictable events.

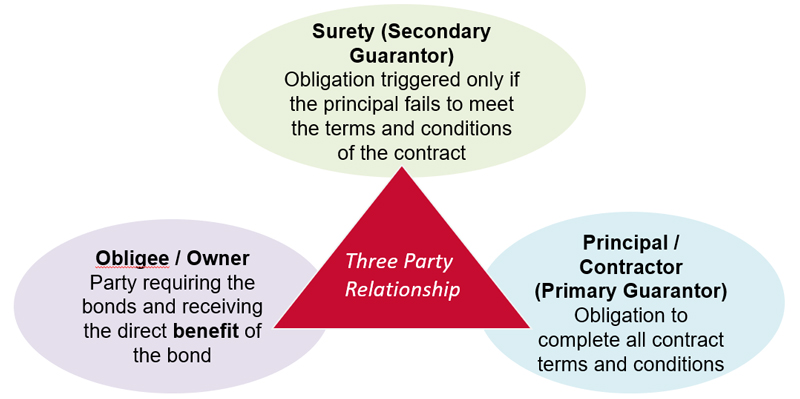

Bonds are three party agreements as outlined in the diagram below:

Surety bonds are commonly used in the construction industry, where they protect project owners against the risk of a contractor failing to complete contracted work or fulfill their obligations under a contract. They can also be used in various other industries, such as the service industry, where they may be required to guarantee the performance of a specific service or the fulfillment of a contract.

Regulations and Types of Contract Bonds

In Canada, surety bonds are regulated by the Financial Services Commission of Ontario (FSCO). The FSCO sets the requirements for obtaining a surety bond, including the amount of the bond, the type of bond required, and the qualifications of the surety company issuing the bond. However, specific Underwriters each have their own unique underwriting philosophies and risk profiles for different sectors of business.

There are several different types of contract surety bonds available in Canada, including bid bonds, performance bonds, and payment bonds. There are also numerous kinds of commercial bonds that are utilized across the country. A bid bond is used to guarantee that a contractor will enter into a contract at the bid price if they are awarded the project (commonly in the amount of 10% of contract price). A performance bond guarantees that the contractor will complete a specific project in accordance with the terms of the contract. A Payment Bond guarantees that the contractor will pay their accrued expenses to subcontractors and suppliers for a specific project.

Surety Bonds in the Construction Industry

The use of surety bonds in the construction industry has several benefits. For example, they provide assurance to project owners that the contractor they hire will complete the project as specified in the contract. This can be particularly important for large, complex construction projects, where the consequences of a contractor failing to fulfill their obligations can be significant.

It’s important to understand that the contractor obtaining the bond for the owner is not ‘covered’ by the bond. They are still financially responsible for any losses that could occur, but the bond will secure this payment to the owner from the surety company. The surety underwriter will then pursue a recovery from the failed contractor under what’s called an indemnity agreement.

Surety bonds can also provide financial protection for subcontractors and suppliers. In the event that a contractor fails to pay their subcontractors or suppliers, the surety company that issued the labour material & payment bond will step in and cover the costs. This can provide peace of mind for subcontractors and suppliers, who may be concerned about not getting paid for the work they perform.

In addition to protecting project owners, contractors, subcontractors, and suppliers, surety bonds can also help to ensure the quality of construction projects. By providing a financial guarantee that the project will be completed according to the terms of the contract, bonds can incentivize contractors to perform high-quality work. This can help to ensure that construction projects are completed on time and to the specified standards.

How To Get Bonded

Of course, obtaining a surety bond, depending on the type, is not without its challenges. In order to setup a bond facility for bid bonds, performance bonds, etc., the applicant must provide detailed information about their financial situation, assets, liabilities, project history, and personal net worth. This can be a daunting prospect for some contractors, particularly those who are just starting out in the construction industry.

Not to worry! We’re here to help and invite you to setup a consultation to get your bonding process started.