RPP Bond

Release Prior to Payment Bond

Canadian Border Services Agency / CARM

An RPP Bond (Release Prior to Payment Bond), also referred to as a Release of Goods Prior to Payment of Duties Bond is a requirement for domestic & international importers in order to guarantee Canada Border Services Agency (CBSA) import taxes owed. We offer a simple, competitively prices, online solution for commercial importers to manage their security requirements for the CARM program.

What is a Release Prior to Payment (RPP) Bond?

A Release Prior to Payment Bond is a type of surety bond that is designed to ensure CBSA is paid any duties owed on commercial goods being imported into Canada. The RPP Bond is typically provided on a D120 Bond Form / Customs Act for resident importers and GST114 Bond Form for non-resident importers.

If your business is not Canadian, please see our Non-Resident GST Bond page for more information and to apply for a bond.

The minimum security requirement for RPP Bonds at this time is $5,000; however, this is subject to change as CBSA / CRA implement and adjust for CARM.

Why do I need an RPP Bond?

Importers mush provide either cash or an RPP Bond to the CBSA to guarantee the payment of taxes and duties applicable to their import operations. The Canadian Border Services Agency has a mandatory financial obligation to all commercial importers. An RPP Bond is a cost-effective and user-friendly form of security that will not require collateral to be tied up to remain compliant with the Customs and Transportation Act, which should be reviewed in detail.

Is this a continuous RPP Bond?

Yes! We are able to issue continuous RPP Bonds that will renew year after year. If you are unsure about any of the specifics of your Release of Goods Prior to Payment of Duties Bond, or you have any questions, don’t hesitate to book a consultation with us. You may also want to read more regarding Customs Bonds here.

Why is CBSA implementing new CARM requirements?

Canada Border Services Agency has designed new CARM (CBSA Assessment and Revenue Management) requirements as a modern business tool for Canada’s importing community. This new system aims to simplify the importing process and enable online self service for:

- Creating and Managing Accounts

- Classifying Goods

- Making Secure Payments

- Delegating Account Access

- Submit Ruling Requests

- Register for a Business Number

- Submit a Commercial Account Declaration

- Submit Appeals

- and more…

The RPP Bond is part of these new CARM requirements and is now the responsibility of each individual importer.

Do I qualify for a Release Prior to Payment (RPP) Bond?

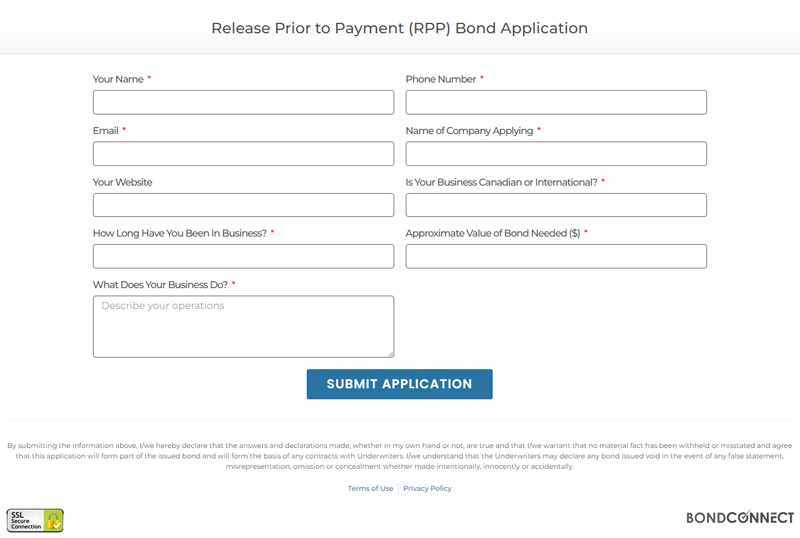

If the financial obligation for your RPP Bond is less than $100,000, it is relatively simple and painless to be approved and purchase your bond. You will need to fill our a brief application on our website and sign an indemnity agreement which commits to responsibility for the bonded amount.

If your RPP Bond requirement is greater than $100,000, surety bond underwriters typically need to review the following to gauge qualification and approval for the guaranteed amount:

- Complete online application by the importer.

- Executed Indemnity Agreement (this is a document that confirms reimbursement to the surety should CBSA file a bond claim).

- Importer’s most recent Year-End Financial Statements (typically Review Engagement or Notice to Reader)

Apply for your bond today and our expert staff will guide you through the process to ensure a smooth purchasing experience and answer any questions you may have.

How much does an RPP Bond cost?

The cost of a Release Prior to Payment (RPP) Bond will depend primarily on the value of the bond required. We are able to offer rates for RPP Bonds as low as $375 premium per year. For example, a $25,000 bond will typically cost $400 annually.

When looking at bond amounts exceeding $25,000, there are rate formulas that apply depending on information gathered about your business. These rates typically cost between 0.4% to 1.5% of the bond obligation. Example: a $100,000 bond will likely cost in the $1,525 per year range.

Completing our online application and pursuing a quote for your bond does not cost anything or require that you proceed with purchasing the bond once a quote is obtained.

Client service and transparency for customers are our top priorities.

CARM & CBSA Compliant

Best Price Nation Wide

Reliable Underwriters

Online Bond Application

Automated Renewal Reminders

How It Works

CBSA Extends CARM RPP Transition Period to May 20, 2025

The Canada Border Services Agency (CBSA) has announced a further 30-day extension to the transition period for importers to comply with financial security requirements under

Navigating CARM: Understanding RPP Bonds for Importers

Whether you’re a domestic importer or a foreign entity, navigating the constantly evolving import requirements in Canada can be difficult. That’s why we’ve developed a