Administration Bond

Executor Bond for Estate Administrator

An Administration Bond, also known as an Executor Bond or Trustee Bond, is a type of surety bond that provides a financial guarantee for the proper administration and management of an estate, trust, or guardianship. This bond is typically required by the court or government agency that oversees the administration of the estate or trust, and is meant to protect the beneficiaries from any financial loss that may occur due to the actions or inactions of the administrator or trustee.

What is an Administration Bond?

An Administration Bond is a type of financial instrument that provides a guarantee for the proper handling and management of a trust or estate. It is usually required by a court or government agency that oversees the administration of an estate or trust. In Canada, this is typically the provincial Public Guardian and Trustee or the PGT. The bond serves as a financial guarantee that protects the beneficiaries from any financial loss that may result from the administrator’s or trustee’s actions.

Essentially, an Administration Bond assures the court and the beneficiaries that the administrator or trustee will carry out their responsibilities with honesty, integrity, and in compliance with the law. If you’re involved in estate administration or trust management, it’s important to understand the significance of obtaining an Administration Bond to safeguard against any potential risks.

Why are Administration / Executor Bonds required?

By obtaining an Administration Bond, the administrator or trustee can assure the court and the beneficiaries that they will act with honesty and integrity, and will fulfill their fiduciary duties in accordance with the law. The bond protects the PGT and by extension, the beneficiary from financial loss for the value of the estate / bond from a potential estate executor mismanagement. This type of bond is typically a court order and often times a lawyer will oversee the process for the administrator.

It is important to note that this bond does not serve as a protection instrument for the administrator, but rather a form of security for the regulatory body requiring the guarantee. Some of the situations where Administration Bonds are required are as follows:

- Individual inherits the estate of a deceased person (without a valid will), but is too young to manage.

- Individual whom inherits an estate is deemed incompetent to manage. This can include disabilities, diseases, and other scenarios determined by the courts.

- An Individual gets into an accident or has an occurence where they are no longer able to manage their own estate and need to select (court assisted) an administrator.

Once a bond is issued in the name of estate trustee, the complete value of the estate is protected by the bond for the total value the courts require. The bond will then be in place until a court ordered release is received and provided to the bonding underwriter.

Is this the appropriate Bond for Executor of Estate?

Yes. This is the bond typically required when there will be an appointed executor of estate. There are numerous different scenarios where Administration Bonds are required by the Public Guardian and Trustee (PGT) or other regulatory body. The terminology and name of this bond may sometimes vary and can include:

Executor Bond

Committeeship Bond

Guardianship Bond

Fiduciary Bond

As Administration Bonds have traditionally not been an extremely common type of surety bond, there are sometimes ambiguous terminologies used and varying obligations that the courts require. Don’t hesitate to reach out to us to get things started and our professional staff will ensure you’re on the right track.

If you'd like to learn more or discuss an Administration Bond requirement, we're happy to help.

How much does an Administration Bond Cost?

The cost of an Administration Bond will vary depending on different aspects of the specific case in question, but are typically approximately 1% to 2% of the guaranteed / bonded amount per year.

For example, if an Admin Bond of $1,000,000 is required, the cost will be in the $10,000 – $20,000 range annually. Some of the details that affect the price of a bond will include:

- Amount of the estate / bond requirement.

- Duration of the bond to be in place.

- Specifics of the situation and why the bond is needed.

- Current market conditions in the surety bond industry.

- Underwriting discretion & perspective.

- Any other information provided & urgency required.

It’s important to note that depending on estate trustee variables including the total bond amount needed, it may be a requirement that multiple years of premium be paid up front for a bonding company to issue administration bonds.

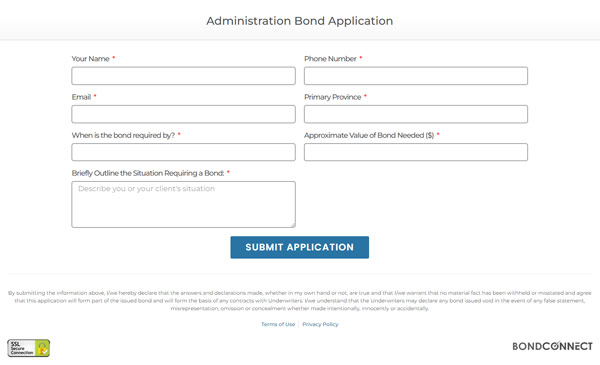

What does an Administration Bond Application look like?

Each situation is unique and sometimes less or additional information & documentation will be requested from Surety Bond Underwriters; although, in general we typically request the following information for a complete application:

- Fiduciary Application Form (provided).

- Asset management plan / schedule of assets of the estate.

- Copy of any applicable death certificates.

- Copy of the valid will of the deceased person (if applicable / available).

- Copy of any probate application materials.

- Summary of any estate beneficiaries.

- Personal Net Worth Statements for any administrators to ensure financial security.

- Copy of any materials / recommendations from the Public Guardian & Trustee (PGT).

The application process can appear time consuming, but we work diligently with underwriters to reduce any delays in communication and document review.

The estate trustee being agreed upon by probate court will be the pillar of the application as underwriters and authorities will want to ensure competency of the named executor. Not to worry, our professional staff will walk you through the entire application process and ensure any probate court requirements are met. If multiple years of premium is paid and the bond can be released from obligation of the estate trustee, the pro-rated amount would then be returned from the bonding company.

Reliable Canadian Underwriters

Capability for US Guarantees as well

Unique Underwriting Solutions

Online Bond Application

E-Bonds When Possible

RECENT RELATED ARTICLES

Administration Bonds: A Comprehesive Guide for Canadian Lawyers

As legal professionals, lawyers play a crucial role in protecting their clients’ interests and ensuring compliance with legal requirements. In certain situations, lawyers may need

What Does Artificial Intelligence Mean for the Surety Industry?

An Introduction to OpenAI and ChatGPT OpenAI is a leading artificial intelligence research laboratory that is widely known for its innovative approach to machine learning