We often have client inquiries from businesses stating that they need a fidelity bond for their cleaning company or moving company. However, this is an antiquated term and bond type in the Canadian market and has since been replaced with an insurance product. Let’s jump into Fidelity Bonds vs Surety Bonds and why they’re different.

In 2025 and onwards, fidelity surety bonds are not available in Canada and the product you’re likely looking for is either “crime coverage” or “3D fidelity insurance” – this used to be called a “3D fidelity bond”.

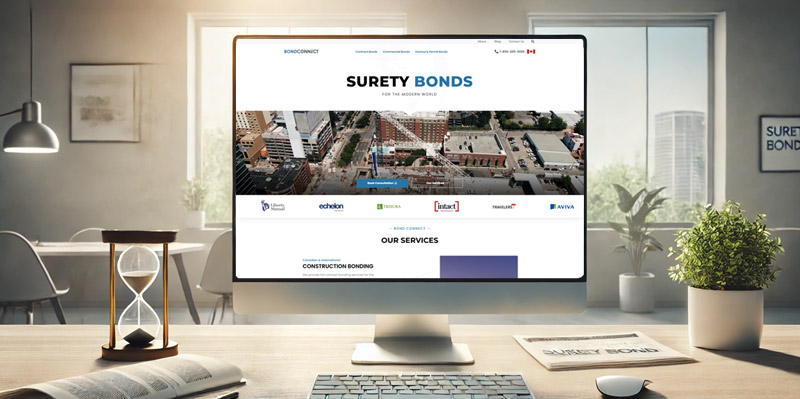

Neither of these forms of coverage are products that Bond Connect offers as they are not surety products at all. We recommend getting in touch with your insurance broker if you’d like to obtain this form of protection.

What the above listed insurance products are for is protection for your clients, should one of your employees steal, damage, or destroy property.

The crime insurance product protects your business from being held accountable for one of these occurrences. Of course, to purchase this coverage – you will in fact need to have employees. After all, you understandably can’t purchase a policy to cover yourself from stealing from one of your clients

So why the terminology of "Fidelity Bond"?

Dating back to the 1980’s in Canada, there was a surety bond product that was titled a fidelity bond or cleaning bond where cleaning businesses would purchase this as a way to display reliability and instill confidence from their customers.

However, time has shown that this product and assurance is better suited as an insurance product as surety bonds still have the principals of the bond need to compensate an underwriter should there be a claim under the bond. Therefore, the bond (and saying that your business is “bonded”) may appear helpful on the surface, but from the principal’s perspective, they’d still be on the hook for damages or disappearance of a client’s property.

This is again why this product moved to being an insurance policy rather than a surety bond.

My competitors all claim to be "bonded"

If you run a cleaning business and have seen your competitors stating that they are “bonded” and insured; this is likely not the case and the terminology is being misused. There are actually very few cleaning companies that are truly bonded.

It’s possible that the business has purchased a crime policy or 3D fidelity coverage and is now claiming to be bonded. This could be an honest mistake, but it leads to questions from competitors and likely clients as well.

At this time in Canada, the only surety bonds that could be applicable to cleaning businesses, estate service businesses, moving companies, and other operations where you may have access to client property are the following:

- General Surety Bond (Alberta)

- Prepaid Contractor Bond (Alberta)

- Bond Facility – we’ll delve more into this shortly

- Performance Bond

- Potentially assorted license & permit bonds in a specific region

What does it take to be "bonded"?

For your business to be bonded; a few parameters need to be met.

- There needs to be an entity requesting for a bond to be issued. This is called the Obligee and it’s the party that receives benefit from the bond. Government of Alberta for example in the case of the General Surety Bond, AB.

- There needs to be a specific bond wording that the Obligee is requesting. You can’t just obtain arbitrarily a bond – it needs to be a certain type of bond. Again, here is the template provided by the Government of Alberta for the General Surety Bond.

- You need to qualify for the type of bond you are requesting. This can be fairly straight forward for some types of bonds, but more complex and in-depth for other kinds. Most license & permit bonds don’t require much underwriting to issue.

It is not recommended (or even possible) to go arbitrarily purchasing surety bonds for your business unless a specific bond type has been requested by an Obligee. This Obligee could be someone you’re working for on a large-scale contract, or a licensing body like a government entity.

Next, we’ll jump into what a bond facility is and how this could be a viable solution for being able to state that “your business is bonded”.

Bond Facility for Cleaning, Moving & Other Businesses

Think of a bond facility as an annual subscription to be able to provide the contract bonds that you need throughout the year.

It entails a detailed overview of your business including:

- A Contractors Questionnaire

- Personal Net Work Statements for each shareholder

- Most Recent Accountant Prepared Financial Statements

- Recent Internal Financial Statements including

- Balance Sheet

- Income Statement

- Aged Receivables Listing

- Aged Payables Listing

- Work In Progress Report

- And more depending on your business tructure

The goal of reviewing all of these details is so that underwriters can determine whether or not they are willing to post security in the form of bonds for your business.

In the cleaning industry, we wouldn’t expect to see bond requirements for contracts less than $500,000, but there could be a exceptions.

In order to qualify for a bond facility and the capability of providing contract bonds like a Bid Bond or Performance Bond – there is a minimum working capital requirement of around $150,000 in your business.

This means that your company needs to have $150,000 in cash-on-hand, without offsetting liabilities.

A bond facility is meant for established businesses with solid track records and is not something that is easily attainable for new companies or startups.

All of this is to say that unless you’re going after large scale contracts, or you’re in a region where a government licensing body requires a surety bond – you probably don’t need to be “bonded”.

Fidelity & Surety Bond FAQs

Q: What is a fidelity bond, and is it still available?

A: Fidelity bonds are an outdated product in Canada. They have been replaced by insurance products like “crime coverage” or “3D fidelity insurance.” These products protect your clients if an employee causes theft, damage, or loss.

Q: Does Bond Connect offer 3D fidelity or crime insurance?

A: No. Bond Connect specializes in surety bonds, which are different from insurance products. For crime or fidelity insurance, reach out to your insurance broker.

Q: Why do some cleaning companies say they are “bonded”?

A: The term “bonded” is often misused. Many companies claiming this may have crime insurance, not a surety bond. True bonding requires meeting specific requirements and issuing a bond for a particular purpose, and to a specific Obligee.

Q: Are surety bonds relevant for cleaning companies?

A: Only in specific situations, like government licensing commercial bonds or large contracts where contract bonds are needed (typically $500,000+).

Q: Should my business get “bonded”?

A: If your clients or a licensing body doesn’t require it, you likely don’t need a surety bond. If you are uncertain if a surety bond is needed, or have questions, we’d be happy to help!

Concluding Fidelity Bonds vs Surety Bonds

Although being “bonded” may sound nice to your customers, it can’t be done without a specific requirement from one of the entities we outlined above.

If you see competitors in your industry indicating that they are in-fact bonded, we recommend reaching out to that business to request evidence of their bonding.

If they do actually have a surety bond in place, it won’t be an issue for them to provide evidence of such. We have tried it ourselves with numerous cleaning businesses that advertise as being bonded, but have no surety bond in place at all. The reason-being is that there isn’t even a surety bond that is applicable to their line of work.

If you have more questions about being bonded and the products available from Bond Connect, don’t hesitate to reach out to us and we’d be happy to clear things up for you.

If you have an insurance related inquiry, we encourage you to contact your insurance broker that provides your general liability insurance for assistance.

We only do surety bonds, and we’re proud of it!