If you have plans to import goods into Canada or the United States, this is when you might come across customs bonds. So, what is a customs bond, and how do you get one? In our ultimate guide, you’ll read about everything related to customs bonds in Canada.

Please note: CBSA has a moving target on new CARM implementation rulings. Any of the following information is subject to change.

What is a Canada Customs Bond?

A customs bond involves three different parties that make up a financial guarantee. These parties include the principal, customs authority, and bond surety company. The principal imports the record, the customs authority provides protection at the U.S. and Canada border, and the bond surety company is the guarantor that repays CBSA if/when the principal goes into default with their obligations.

With goods importation, you can get a customs bond with an insurance company (the surety company). This bond guarantees the authority that anything owed on the importation of goods, such as taxes, will be paid back. It’s important to mention that if you fail to pay any owed amounts, the insurance company will cover it and move forward with legal action to receive their money back.

Purpose of Customs Surety Bonds

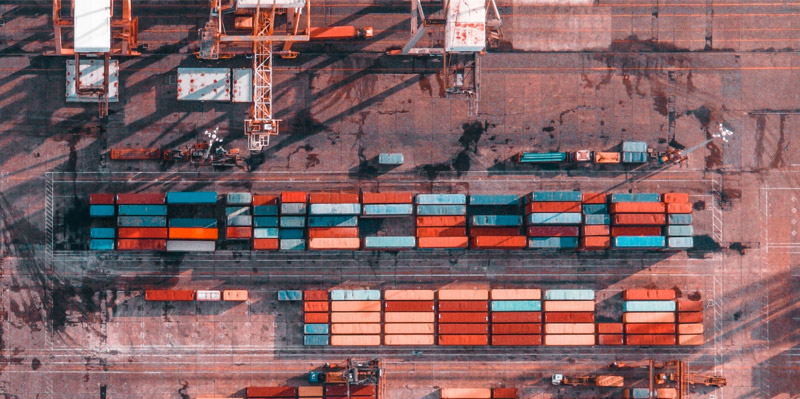

Canada Border Services Agency (CBSA) has a customs bond requirement on specific goods to ensure they get what they are owed on imported goods. With this approach, customs bonds BC will still be able to collect what’s owed even if an importing business goes bankrupt. With a customs bond, specific goods can enter Canada, and you can pay what’s owed at a later time.

Customs bonds are also used to collect any amounts owed by importers, even though there are different requirements for the United States.

Customs Bond Requirement

The customs bond requirement in Canada is in place to import any specific goods into the country. Any goods worth more than $2,500 may need to have a customs bond in place. This requirement is enforced even if the goods are transported by airplane or boat.

Whether the goods are being imported for personal use or resale, the customs bond requirement can still apply to goods worth more than $2,500. For importing goods into Canada, a customs bond guarantee or cash payment is required. Since many importers find cash payments inconvenient, a customs bond is a more popular option.

Where Can I Get a Customs Bond in Canada?

Now, let’s discuss where you can obtain your customs bond, one of the most vital pieces of information of all. You can contact a surety bond broker like Bond Connect to get a customs bond in Canada or contact a customs broker.

A customs broker can contact the surety company for you, but you may need to give them Power of Attorney. Customs brokers are no longer able to lump all of their clients under a single bond.

What If I Can't Obtain a Customs Bond?

If you can’t get a customs bond in Canada, you’ll likely need to pay any taxes using cash at the port of entry in order to release your specific goods. We know this can be hectic, as it can cause significant delays with receiving shipments.

Varieties of Customs Bonds Canada

There are a couple of types of customs bonds in Canada that importers should know about. These two types of custom bonds include single-entry and continuous bonds.

- Single entry – With these types of bonds, you can only use it for one transaction. These bonds are best used for those who don’t usually import specific goods. We must mention, however, that in the United States, a single entry is only for one shipment. For example, if you’re importing four shipments, you’ll need four single-entry bonds.

- Continuous – With continuous bonds, we prefer these because you can use them for up to a year at each port. If you frequently import goods, this is the best option. Continuous bonds provide the same functions in Canada and the United States.

These bonds are two of the essential types of bonds, but there are others that apply to unique situations. For more information, we recommend getting in touch with us to decide which is best for your situation.

How Can I Apply for a Customs Bond In Canada?

While the application process for receiving a customs bond in Canada is not complex, certain types of information are required to obtain one. This information includes the name of your business, business number, type of business, address, years in business, and a description of what you’re importing.

Once you have submitted and have your customs bond application approved, you will be required to pay a premium per contract regulations.

Apply for a Customs Bonds in Minutes

Who Should Be a Bonded Carrier?

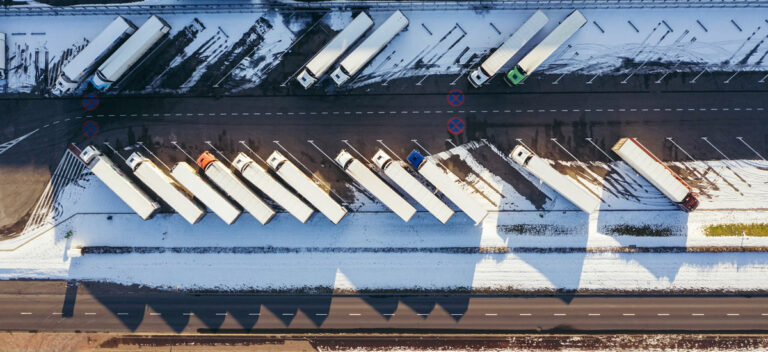

Any facility operators or warehouses who want to become bonded carriers should obtain a customs bond. Any international carrier that provides transportation to passengers by airplane, boat, or vehicle into Canada will likely need to obtain a customs bond. Lastly, anyone wanting to be a customs broker may need to get a customs bond.

How to Become a Bonded Carrier

A bonded carrier is a little more complex than applying for a non-bonded carrier. To become a bonded carrier, carriers must work with an approved insurance company to move forward with their application process. As a carrier, you must have financial security of anywhere between $5,000 and $25,000.

The bonded carrier must include the business’s financials for the reviewing process. Before applying to be a bonded carrier, we recommend you review the guidelines on the Highway Carrier Code Application Process. If you submit all required information correctly and with proper documentation, you should receive your bonded carrier code within three business days

Customs Bonds FAQ

How do I get a Canadian Customs Bond?

To get a Canadian customs bond, you need your business name, Canada business number, type of business listed, address, years in business, and a description of what you’re importing. Applications change from time to time, so please start here and we’ll take care of the rest.

What is a bond fee for a Canadian Customs Bond?

The bond premium is calculated based on the maximum amount of taxes that would typically be paid at any time within the year following getting the license for a warehouse customs bond. Customs bonds can be purchased for as little as $350 per year.

How much should a customs bond be for?

A customs bond will typically be for around ten percent (10%) of the total taxes paid to CBSA yearly at a minimum of $50,000.

When is the CARM implementation date?

CARM will be implemented in 2024, with a moving target for the date. You can read more here: Navigating CARM

Are Customs Bonds for International Businesses only?

We have mostly touched on international clients and their customs bonds requirements in this article; however, there are also customs bonds requirements for Canadian businesses in fields like cannabis and liquor production.