Customs & Excise Bond

Surety Bond for Duties and Taxes

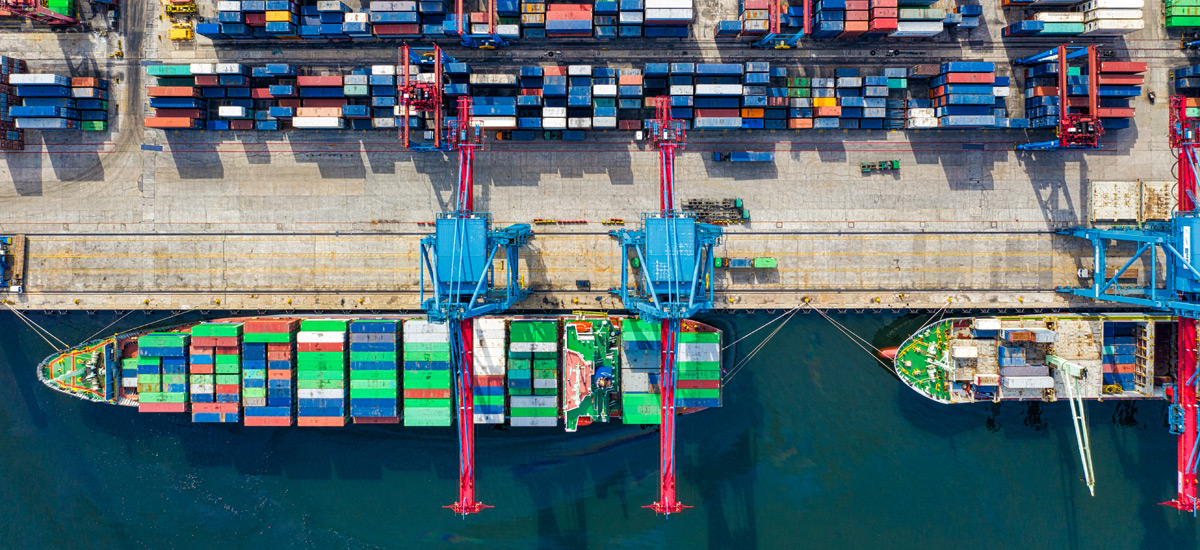

A Customs & Excise Bond is a third party financial security document issued for the national governing bodies of imports and exports. These types of bonds are typically issued to the Canada Border Services Agency (CBSA) in the amount specified by the authority from $5,000 CDN and up. With the new CARM requirements coming into play imminently it’s important to note that the minimum bond amount will likely be increased to $25,000 CDN.

There are various other types of Customs Bonds such as Non-Resident GST Bond for Canada Revenue Agency (CRA).

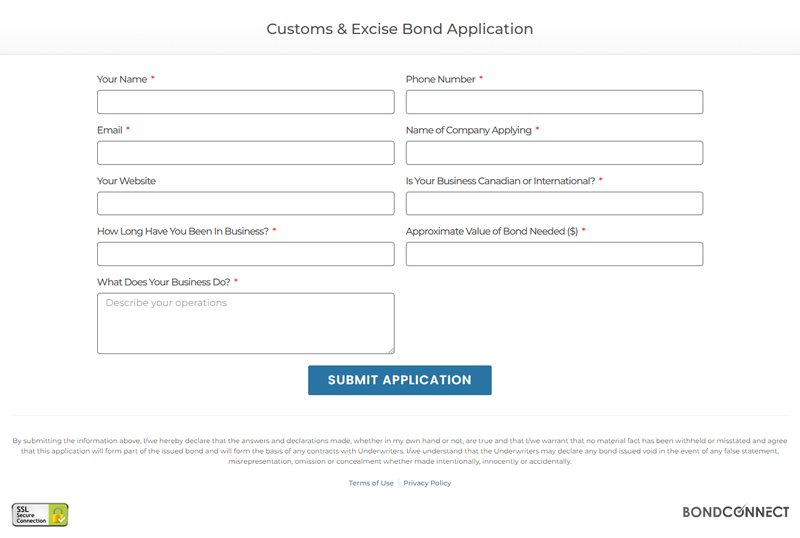

Whether your bonding requirement is for a temporary / one-time import or a continuous customs bond, we’re able to help. Apply for your surety bond online today!

What is a Customs & Excise Bond?

Customs and Excise Bonds are 3 party financial instruments that are used to guarantee that an importer or exporter will provide the payment for any customs, duties, and / or taxes owed on products that are being sent between Canada and a foreign country. They provide security to the controlling governing bodies (such as CBSA) that the adequate amount of duties will be paid even if ‘The Principal’ (you) fails to do so.

Please note, although a customs or excise bond provides protection for the Obligee (Government of Canada or other customs authority entity) for amounts owed for taxation, your company will still be responsible for providing the required / paid funds that a Surety Underwriter may have paid out should a claim under the bond occur.

Why do I need a Customs Surety Bond?

If your operations involve being a customs broker, importer, logistics company, transportation company, or any other entity involved with shipping goods internationally, it is likely that the Government of Canada requires that you obtain a customs bond.

The Canada Border Services Agency has a mandatory surety bond requirement that indicates a financial obligation from a third party to pay for any amounts that may be owed for customs, duties, and taxes. This bond states that your company will remain compliant with the Customs and Transportation Act which should be reviewed in detail.

Can I get a continuous Customs Bond?

Yes! We are able to issue both continuous customs bonds as well as bonds that may only be needed for a one-time or single trip. If you are unsure of the type of customs bond that is required for your operations, or you have any questions, don’t hesitate to book a consultation with us.

We commonly see customs bonds for excise taxes being issued as a continuous bond for legally required duties or applicable excise taxes.

What kinds of Customs & Excise Bonds are available?

There are various types of customs & excise bonds that are available for quoting and purchase online including:

- Bonded Air Carrier

- Bonded Freight Forwarder

- Bonded Highway Carrier

- Bonded Marine Carrier

- Bonded Rail Carrier

- Cannabis Bond

- Carnet Blanket Bond

- Customs Bonded Warehouse

- Customs Broker License Bond

- Customs Sufferance Warehouse

- Brewer, Spirits & Distiller Excise Bond

- Non-Resident GST Bond

- Release of Goods (RPP) Bond

- Single Trip Carnet Bond

- Temporary Importation of Goods Bond

- and more...

The most common Customs and Excise Bonds we see requested are RPP Bonds, Non-Resident GST Bonds, Customs Bonded Warehouse Bonds, Customs and Transportation Bonds, Customs Brokers License Bonds, and assorted Customs Bonds for the Federal and Provincial Governments.

How do I determine the Bond Amount Required?

** Please note: the following requirements may change with evolving CARM adjustments by CBSA **

- Initial Security Requirement: Upon registration, applicants are required to provide security based on 50% of their estimated net tax for the 12 months following registration. This applies whether the net tax is a positive or negative amount.

- Example: If the estimated net tax is $10,000, the required security is $5,000. If the estimated net tax is negative $12,000 (indicating a net refund), the required security is $6,000.

- Initial Security Requirement: Upon registration, applicants are required to provide security based on 50% of their estimated net tax for the 12 months following registration. This applies whether the net tax is a positive or negative amount.

- Subsequent Years: After the initial 12-month period, the amount of security required is adjusted to 50% of the actual net tax from the previous 12-month period.

- Annual Review: The security amount is reviewed annually. If a review indicates that the current security is inadequate based on the person / business’ net tax for the current or previous 12 months, the Minister may require an increase in the security amount.

- Security Range: The security amount is set within a range, with a minimum of $5,000 (may soon change to $25,000) and a maximum of $1 million.

Visit the Gov. of Canada’s page here which outlines in detail security requirements for Non-Residents.

Domestic Canadian businesses follow a similar calculation model which can be reviewed here.

(These links may be changed on the CBSA site as CARM adjustments take affect.)

How much does a Customs & Excise Bond cost?

The cost of a customs / excise surety bond can vary depending on variables like the amount of the bond, duration of the bond, and other unique applicant details (such as financial position).

As your surety broker, we will always strive to obtain the best rates available in the market for the bond you’ve requested. A customs bond can be offered for as little as $375 per year premium, depending on the underwriting details mentioned above.

Filling out our application and pursuing a quote for the bond you require does not cost anything or mandate that you proceed with purchasing the bond once a quote is obtained. Client service and transparency for customers are our top priorities.

Best Price Nation Wide

Reliable Underwriters

Online Bond Application & Approval

Automated Renewal Reminders

Continuous Bond Options

How It Works

Secure Surety Bond Purchase

We work with top A.M. Best Rated Underwriters to ensure CBSA / Canada Revenue Agency are accepting of our security instrumentals, bond wordings, and professional procesing.

We issue bonds backed by guarantors like Trisura Guarantee to ensure best in class surety paper while maintaining a competitive price point.

Online applications, quotes, payment, and soon – bond issuance (pending CBSA’s acceptance of digitally verified ‘e-bonds’).

The Ultimate 2024 Guide for Customs Bonds in Canada

If you have plans to import goods into Canada or the United States, this is when you might come across customs bonds. So, what is

Navigating CARM: Understanding RPP Bonds for Importers

Whether you’re a domestic importer or a foreign entity, navigating the constantly evolving import requirements in Canada can be difficult. That’s why we’ve developed a