General Surety Bond Alberta

Surety Bond Alberta for Licensing

A General Surety Bond, Alberta is a type of commercial license & permit bond that is a requirement for obtaining a license or operating in various fields of business in the province. These bonds are often in relatively small amounts as far as surety bonds go (commonly $10,000 to $75,000) and protect Alberta’s regulatory bodies from bad actors in their respective industries.

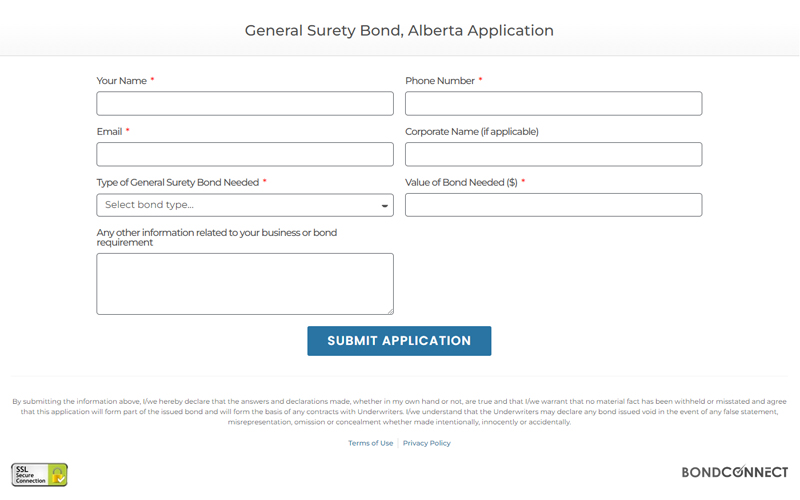

We’re able to offer simple and quick online applications, approvals, and payments for Alberta bonds of all types.

What is a General Surety Bond in Alberta?

A General Surety Bond is a three-party security agreement between the Principal, the Surety Underwriter, and the Obligee. This bond ensures that the Principal adheres to all regulations and guidelines as required by the relevant authority. The bond acts as a guarantee that the Principal will fulfill its obligations, and if not, the Surety will compensate the Obligee for any losses.

For clarity, the three parties involved are:

- The Principal – This is the entity, whether a company or individual, that is seeking the bond and is responsible for any losses that might occur under the terms of the surety agreement.

- The Surety – This is the insurance company that provides the financial backing for the bond, ensuring that the Principal will meet its commitments.

- The Obligee – This is the party to whom the bond’s guarantee is made. For a General Surety Bond, it could be a government agency, a private entity, or any other organization requiring the bond.

At Bond Connect, we pride ourselves in ensuring we align your contractual obligations with an appropriate surety company that will provide an adequate guarantee for your requirements.

Why do I need a General Surety Bond, AB?

General Surety Bonds are often required by government entities to ensure that businesses or individuals adhere to specific regulations or fulfill certain obligations. They act as a form of protection for the Obligee against potential losses caused by the Principal’s failure to meet its commitments.

For instance, a government agency might require a General Surety Bond from contractors to ensure they complete public projects as per the agreed terms. However, most of the time it’s a licensing requirement to obtain a surety bond to operate in compliance with provincial regulations.

Can I get a continuous General Surety Bond?

Yes, continuous General Surety Bonds in Alberta are available, allowing the Principal to renew the bond each year without undergoing the entire application process again.

This continuous surety bond validity ensures that the bond remains in effect for as long as the Principal requires it, provided all terms are met and premiums are paid.

What different industries are General Surety Bonds available for?

We are able to offer full service bonding across all industries, but these bonds are most commonly needed in the following sectors of business:

- Auction Sales Business

- Collection Agency

- Debt Repayment Agency

- Direct Sellers

- Electricity Marketers

- Employment Agency Bond

- Fund-raising Business

- Home Inspection Business

- High-Cost Credit

- Natural Gas Marketers

- Payday Lender

- Prepaid Contractors Bond

- Retail Homes Sales

- Time Shares & Points-Based Contracts

- and more...

If you’re unsure about which type of bond you require or have any other questions, don’t hesitate to contact us and a surety bond professional will assist you.

How much does a General Surety Bond in Alberta cost?

The cost of a General Surety Bond depends on certain variables such as the bond amount, duration of the bond, and other unique applicant details. As your surety broker, we will always strive to obtain the best rates available in the market for the bond you’ve requested. In Alberta, these bonds can be offered for as little as $375 per year, depending on the underwriting details mentioned above.

Filling out our application and pursuing a quote for the bond you require does not cost anything or mandate that you proceed with purchasing the bond once a quote is obtained. Client service and transparency for customers are our top priorities.

What other kinds of bonds are available?

Whether it be construction bonds, permit bond, payment bonds or any other financial guarantees, we’re here to help.

E-Bonding

We always have the capability of providing verified “E-Bonding” that is in compliance with the Surety Association of Canada’s required criteria outlined here.

Best Price Nation Wide

Reliable Underwriters

Automated Renewal Reminders

Continuous Bond Options

Online Bond Application

How It Works

6 Tips On How To Get Bonded In Alberta

Understanding how to get bonded in Alberta is a pivotal step for businesses aiming to establish themselves in this dynamic province that fosters fair competition.

Why Should My Business Be Bonded?

As a business owner, you’re always looking for ways to protect your company’s interests. One important way to do this is by getting bonded. A