Labour & Material Payment Bond

L&M Bond for Contract Surety

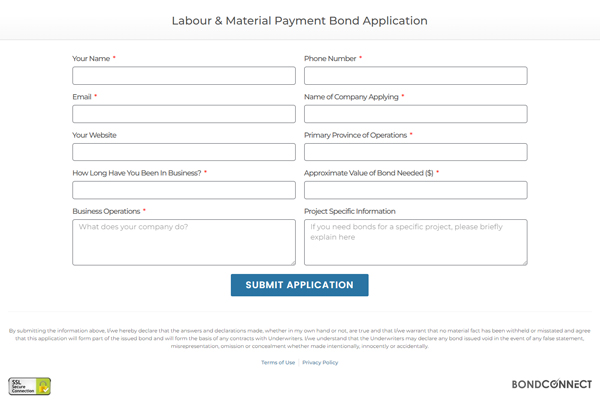

Are you in the process of obtaining a contract that has Labour & Material Payment Bond Requirements? Well then, you’ve come to the right place! We provide complete contract bonding services to clients of all types in any industry. In order to have the capability of providing an L&M Bond, you’ll need to setup what’s called a Bond Facility. Learn more below and apply online today!

What is a Labour & Material Payment Bond?

A Labour and Material Bond provides security for a Principal’s subcontractors and suppliers in the case that the prime contractor fails to, or is unable to pay them for work rendered or materials supplied. It is a three party financial agreement that guarantees a Surety will pay out the said subcontractors / suppliers in the event of a company default on a specific contract.

L&M Bonds are most frequently issued along with a Performance Bond and have a standard value of 50% or 100%.

Why do I need a Labour & Material Payment Bond?

L&M Bonds are frequently required on projects in the public sector. If you’ll be performing a significant sized contract for a municipal client, chances are you’re going to need to provide a Labor & Material Payment Bond. The short answer is, you need it because they require it. It definitely provides peace of mind to the contract owner (also called the Obligee), subcontractors, as well as suppliers and is a good form of a structured risk mitigation plan.

Labour and material bonds play a pivotal role in the construction industry. They ensure that subcontractors and suppliers are paid for their services and materials, even if the prime contractor defaults. This bond acts as a safety net, providing assurance to all parties involved. Depending on which wording is being used (eg. CCDC), a Payment Bond may need to be issued alongside a Performance Bond.

What types of businesses can we provide L&M Payment Bonds for?

We provide contract bond services including the capability of issuing Performance Bonds to contractors of all types. These include:

General Contractors

Municipal Contractors

Road Builders / Pavers

Bridge Builders

Electrical Contractors / Electricians

HVAC Contractors

Site Servicing Contractors

Infrastructure Contractors

Landscape Contractors / Landscapers

Roofing Contractors

Drywall Contractors

Glass Installers

Developers

Garbage Disposal Contractors

Recycling Contractors

and more...

It is also sometimes common for an L&M Bond to be referred to as part of “Construction Bonds“, although they are certainly not limited to the construction industry.

How much does an L&M Payment Bond cost?

A L&M Bond’s cost will depend on various factors and will be stated in the terms & conditions of your Bond Facility once it has been setup.

It is standard practice for a Labour & Material Bond to be issued in conjunction with a Performance Bond as well. Common amounts and contract requirements in Canada dictate that a 50% Performance Bond and 50% Labour & Material Payment Bond are often the go-to security for those seeking bonding as a form of risk mitigation. These, so-called 50/50 Bonds have a standard rate of $10 / $1,000 based on the contract value; therefore, you can determine these bonds will cost approximately 1% of a contracts overall value. However, it’s important to note that contractors obtaining bonding for the first time typically have a higher rate than this, often in the $15 / $1,000 range. Depending on which industry and the financial position of a company, rates can even reach $25+ per $1,000.

As your Surety Bond Broker, we aim to obtain contract bond rates for you as low as possible and have a successful track record for rate negotiations with Underwriting firms.

It’s also important to mention that the ability to obtain any contract bonds in general is part of a form of annual subscription called a Bond Facility which has varying costs, but is typically in the range of $3,000 per year.

Surety Bond Rate Calculator

Based on a CCDC standard 50% Performance Bond and 50% Labour & Material Payment Bond with a 1 year warranty term.

1 month

Please note, this calculator is based on a $12.50 / $1,000 bond rate which is common for new bond facilities; however, this amount can be more or less depending on various aspects of your business and contract specifics. This rate calculator is for estimation purposes only.

The importance of Labour and Material Bonds

Payment bonds are essential in the construction industry. They ensure that subcontractors and suppliers are compensated for their work, even if the primary contractor defaults on their obligations. This bond acts as an assurance to all parties involved, ensuring that projects run smoothly without financial hiccups.

When entering a direct contract, it’s crucial to understand the implications and requirements of bonding. A direct contract often necessitates the need for bonds like the Labour & Material Payment Bond to ensure that all parties involved are protected. This is especially true when subcontractors and suppliers are involved. The bonded contractor is seen as more reliable and trustworthy in the eyes of the contract owner.

A bonded contractor signifies reliability and commitment. When a contractor is bonded, it means they have the backing of a surety company, ensuring they meet their contractual obligations. This is especially important for large projects where the stakes are high. Payment bonds, for instance, are a type of bond that ensures that all parties involved in a project are paid as per the contract.

What other kinds of bonds are available?

Besides an L&M Bond, the typical Surety Bond requirements can almost all be provided through your Bond Facility, these include but are not limited to:

E-Bonding

We always have the ability of providing verified “E-Bonding” that is in compliance with the Surety Association of Canada’s required criteria outlined here.

We offer all of these products and guide you through the process of obtaining them. Selecting the right bond company is essential.

The surety underwriter stands as a guarantor, ensuring that payments are made as stipulated in the bond. A reputable bonding company can make the difference between smooth bond issuance / project execution and potential delays.

Issue the Payment Bond needed by your company

Issue other bonds like Performance Bonds

Reliable Canadian Underwriters

E-Bonds when possible

Annual Bond Facility Guidance

How It Works

Step 2

Our expert staff will guide you through the process of obtaining the Labour and Material Bond you need.

Step 3

Have the Payment Bond and any others you may require issued so you can get back to running your business.

How Does A Bond In Construction Work?

In the construction industry, where every project stands as a testament to innovation and collaboration, the shadows of uncertainty and risk linger. Enter surety bonds,

What is the Meaning of Bondable in Canada? The “3 C’s” of Surety

Surety bonds play a crucial role in various industries and sectors across Canada. They provide a level of financial security and guarantee that a business