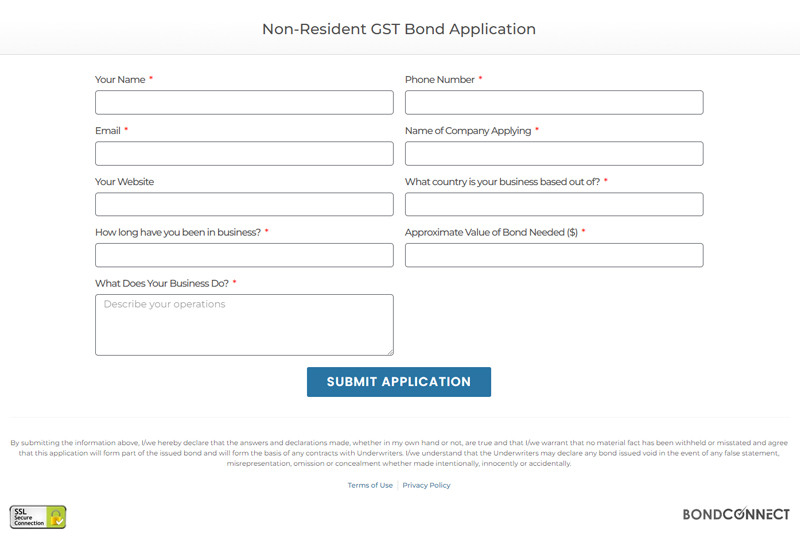

Non-Resident GST Bond

Canada Customs Bond

A Non-Resident GST Bond is a Canadian Customs Bond that provides financial security for national import governing bodies such as Canada Revenue Agency (CRA) & Canada Border Services Agency (CBSA). The bond value required is typically between $5,000 and $500,000; however, larger bond values are available for qualifying parties. Whether your company needs a temporary or continuous GST bond, we can assist. Apply for a Non-Resident GST Bond online and we’ll begin the quoting process.

CRA refers to this bond as a GST114 Bond for Non-Resident Person without a Permanent Establishment in Canada. You can visit the Government of Canada’s bond information page here. We utilize the form approved by the Minister of National Revenue bond template subsection 240(6) of the Excise Tax Act Goods and Services Tax / Harmonized Sales Tax.

What is a Non-Resident GST Bond?

A Non-Resident GST Bond is a three party financial instrument that guarantees a foreign exporter that is importing goods will provide adequate payment for any customs, duties, or taxes owed on products that are being imported to Canada from a foreign country. It provides assurance for governing bodies (like CBSA) that the required duties will be paid even if you (The Principal) fails to do so.

It is important to note that although a customs bond provides ‘coverage’ from the perspective of the Obligee (in this case, the Government of Canada), you are still responsible for providing the required / paid funds to the Surety company providing the financial backing if a claim under a bond occurs.

Why do I need a Non-Resident GST Customs Bond?

If you are performing any of the following operations, it is likely that the Government of Canada requires you to obtain a Non-Resident GST Bond of other Customs Bond:

- Importer

- Customs Broker

- Transportation Company

- Logistics Company

- Any entity that deals with shipping goods from outside of Canada

The Canada Border Services Agency has a surety bond requirement to ensure a financial obligation from a third party is able to pay any amounts owed should you (The Principal) not comply with the Customs and Transportation Act. These details are outlined by the Canadian Government and your company is liable to provide recovery funds up to the maximum of the bond amount should the above stated government act not be followed.

Is this a continuous Non-Resident GST Bond or a one-time guarantee?

We are able to facilitate both continuous and one-time or single trip customs bonds. If you are unsure about which type of bond you will need, don’t hesitate to get in touch with us and we can help identify what is required. In most cases, only Carnet Bonds can be issued on a ‘one-off’ or single time basis.

How much does a Non-Resident GST Bond cost?

The cost for a Non-Resident GST Bond / Customs Bond will vary depending on specific variables of the required bond. Everything from the value of the surety bond, duration of the bond, and other applicant specific information including financial statements may affect premium costs. A Non-Resident Customs GST Bond can be offered for purchase as low as $375 CAD per year, depending on the underwriting information provided.

When looking at bond amounts exceeding $100,000, there are rate formulas that apply depending on the financial position and type of business. These rates typically cost between 0.4% to 1.5% of the bond obligation. Example: a $100,000 bond will likely cost in the $1,525 per year range.

Completing our application or pursuing a quote for your surety bond does not cost anything or require you to proceed with purchasing the bond once a quote is provided – customer services is our top priority.

Reliable Canadian Underwriters

Online Bond Application

Automated Renewal Reminders

E-Bonds When Possible

Best Price Nation Wide

How It Works

Navigating CARM: Understanding RPP Bonds for Importers

Whether you’re a domestic importer or a foreign entity, navigating the constantly evolving import requirements in Canada can be difficult. That’s why we’ve developed a

What Does Artificial Intelligence Mean for the Surety Industry?

An Introduction to OpenAI and ChatGPT OpenAI is a leading artificial intelligence research laboratory that is widely known for its innovative approach to machine learning